TOP 10 International Money Transfers Companies in 2024: Solving Your International Money Transfer Problem.

Sending money to Remote places has turned out to be as easy as sending a textual content message. Whether you are supporting cherished ones abroad, managing international money transfers, or want to get knowledge about the top 10 International Money transfer companies in 2024 for sending money or transferring money in the international world I know this is a big challenge for many people looking to send money from 1 region of the world to the other what is the criteria of sending money to other regions? what are the criteria for receiving money from other regions, cities, or countries? or investing in your global adventures, finding a dependable and fee-powerful cash-sending provider is important. With a multitude of options available, deciding on the right provider can be a frightening venture. This complete manual will get to the bottom of the complexities of worldwide cash transfers, empowering you to make informed choices with self-belief.

What is a money transfer company?

Money transfer companies provide a more cost-effective way to transfer money internationally.

While they offer the same level of safety and security as a bank, their rates are better and fees are lower.

There are a few different types of money transfer companies:

- Remittance company

- Money transfer app

- Currency broker

Remittance companies, like Western Union and Moneygram, are best for ultra-small payments.

I’m talking between £100 and £500, for paying bills or sending money to family.

This is because their rates and fees are high in comparison to the other types.

However, they offer more transfer options and destinations.

Money transfer apps are great for transfers between £500 – £5000.

Examples are Wise and XE.

Their rates are good and fees low, but there’s one caveat.

You download an app, sign up, and do all the work yourself. There’s no one to speak to.

When transferring large amounts, I always like to have someone there to help me.

That’s where currency brokers come in.

For any transfers over £5000, companies like Key Currency and Currencies Direct are best.

This could be for property purchases or sales, or repatriating inheritance.

You’ll get a great rate and impeccable service. Just call them whenever you want and get the help you need.

Unmasking the Challenges:

Understanding the Hiccups of International Money Transfers

Before embarking on our quest for satisfactory international cash switch agencies, permit’s first renowned the not-unusual pain points that often plague customers:

Hidden Fees and Unanticipated Costs: Transparency is usually a casualty within the international of money transfers. Hidden expenses, unfavorable alternate charges, and further expenses can extensively inflate the actual value of sending money overseas.

Complex Transfer Processes: Navigating the labyrinth of switch tactics can be frustrating, mainly for first-time customers. Long verification techniques, bulky documentation, and problematic fee strategies can upload needless complexity.

Delays in Transfer Arrival:

Time is of the essence whilst sending money internationally. Delays in transfer arrival can cause financial distress, neglected possibilities, and disruptions in daily life.

Limited Customer Support: When problems arise, prompt and effective customer support is essential. Inadequate help can exacerbate problems and leave customers feeling helpless.

The Top 10 International Money Transfer Companies: A Journey of Discovery

Armed with a knowledge of the common pain points, we now embark on a journey to find the ten satisfactory international money-sending corporations. Each organization is meticulously evaluated based on various factors, which include change rates, charges, transfer pace, customer service, and general user revel.

Wise (Formerly TransferWise): The Borderless Currency Expert

Wise, previously known as TransferWise, stands as a beacon of transparency and cost-effectiveness within the international of international money transfers. Their challenge is to provide truthful and without-boundaries banking revels in, removing hidden charges and supplying the actual mid-marketplace exchange fee. With a person-friendly interface and a focus on innovation, Wise has earned its popularity as a relied-on partner for global residents.

Remitly: Bridging the Gap Between Loved Ones

Remitly is a pioneer in connecting groups across borders, in particular in rising markets. Their mobile-centric approach makes it especially convenient for users to send money to their loved ones overseas. With a focus on pace, affordability, and reliability, Remitly has turned out to be a lifeline for many families globally.

World Remit: Empowering Communities via Affordable Transfers

World Remit’s task is to make international cash transfers handy and low-priced, mainly for those in underserved groups. Their commitment to low charges and diverse fee alternatives, consisting of cash pickups, has made them a relied-on provider for hundreds of thousands of users globally.

Ria Money Transfer: A Legacy of Reliability and Convenience

Ria Money Transfer boasts a long-standing recognition inside the worldwide money transfer enterprise, with a widespread network of physical places and handy cash pickup alternatives. Their online platform is likewise person-pleasant and gives diverse switch methods, catering to a wide variety of customers.

Skrill: Seamless Integration for Online Transactions

Skrill, basically recognized for its online charge platform, has seamlessly incorporated worldwide money transfers into its services. Their aggressive fees, consumer-friendly interface, and integration with other Skrill services provide a convenient and streamlined enjoyment for customers.

OFX: Tailored Solutions for High-Value Transfers

OFX makes a specialty of handling massive-quantity worldwide money transfers, catering to companies and those who want to move full-size amounts of cash. Their knowledge of forex and personalized carrier lead them to a dependable choice for excessive-fee transfers.

PayPal: Familiarity and Convenience for Global Users

PayPal, a family name in online bills, has multiplied into global cash transfers, leveraging its worldwide reach and familiarity among customers. Their user-friendly platform and integration with other PayPal services offer a handy choice for many.

Xoom: Specialized Expertise in Key Corridors

Xoom, obtained by way of PayPal in 2015, has mounted itself as a main issuer in particular remittance corridors, including the USA-Mexico market. Their focus on those key regions allows them to provide tailor-made answers and competitive prices.

Azimo: Fast Transfers and Competitive Rates for European Transfers

Azimo, a European-primarily based business enterprise, has received popularity for its fast switch speeds and aggressive change quotes, mainly within Europe. Their cellular app is intuitive and gives a whole lot of payment options, catering to the desires of European customers.

TorFX: Fairness and Transparency for Informed Decisions

TorFX stands proud within the international cash transfer landscape for its commitment to equity and transparency. They provide competitive alternate costs and disclose

10 Best Money Transfer Companies at a Glance

Update for 2023, see the international money transfer companies with the best average fee rates in the world. Compare their services, customer reviews, and other capabilities.

| Rank | Score | Company | Methods | Trustpilot | Markup | Fees | Website |

|---|---|---|---|---|---|---|---|

|

1 |

9.4/10 |  |

Bank deposit, mobile wallet deposit | 4.7/5 | 0% | 0.5% – 2% | Visit |

|

2 |

9.1/10 |  |

Bank deposit, cash pick-up, home delivery, mobile wallet deposit. | 4.1/5 | 0.5% – 2% | $0.00 – $3.99 | Visit |

|

3 |

9.1/10 |  |

Bank deposit, cash pick-up, VISA & MasterCard, ATMs, mobile wallet deposit (depending on country) | 4.8/5 | 3% – 5% | $0.00 | Visit |

|

4 |

9.0/10 |  |

Bank deposit, mobile wallet deposit | 4.6/5 | 0.35% | €3.00 | Visit |

|

5 |

8.8/10 |  |

Bank deposit, debit/credit card | 4.7/5 | 0% – 2.2% | €0.99 | Visit |

|

6 |

8.8/10 |  |

Bank deposit, debit/credit card | 4.8/5 | 0% – 2.2% | €0.99 | Visit |

|

7 |

8.8/10 |  |

Bank deposit, debit/credit card | 4.8/5 | 0% | €5.99 | Visit |

|

8 |

8.5/10 |  |

Bank deposit | 4.6/5 | 0.4% – 1.6% | $3.00 | Visit |

|

9 |

8.4/10 |  |

Bank deposit, debit card, credit card, Paysend Wallet | 4.4/5 | 0.2% – 5% | $2.00 | Visit |

|

10 |

8.4/10 |  |

Bank deposit | 4.4/5 | 0.1% – 0.6% | €3.00 | Visit |

Delving Deeper: Advanced Strategies for Savvy International Money Transfers

As you embark on your global cash transfer journey, remember those superior strategies to maximize your financial savings and streamline your transactions:

- Time Your Transfers Strategically: Exchange rates fluctuate continuously, presenting possibilities to store. Keep an eye fixed on marketplace traits and pick out ability dips to schedule your transfers for more value.

- Harness the Power of Market Orders: Market orders let you set a preferred change fee and execute the transfer while the charge reaches your target. This approach may be particularly useful if you count on favorable rate movements.

- Leverage Forward Contracts: Forward contracts lock in an exchange charge for a destiny transaction, protecting you from potential fee fluctuations. This method is right for massive or habitual transfers.

four. Explore Alternative Payment Methods: Consider opportunity fee techniques, consisting of Wise’s without borderlines account, which helps you to preserve and trade more than one currency at mid-market rates.

- Optimize Transfer Frequency: Determine the most efficient frequency in your transfers, balancing convenience with cost-efficiency. Smaller, greater common transfers may additionally incur lower charges, whilst larger, much less common transfers may provide higher quotes.

- Educate Your Recipients: Inform your recipients about the first-class techniques for receiving funds, thinking about elements like local currency availability, switch charges, and alternate fees.

- Seek Professional Guidance: For complicated or excessive-price transfers, recall consulting a certified forex expert.

Quick Look: My Top 10 Money Transfer Companies

Navigating Complexities with Expert Assistance: The Role of Currency Exchange Specialists

For complex or excessive-value worldwide money transfers, in search for professional steerage from a certified foreign exchange expert can prove helpful. These specialists have an in-depth understanding of market tendencies, regulatory necessities, and tailor-made strategies to optimize your transfers and limit dangers.

Currency Exchange Specialists: Your Navigators in the Financial Labyrinth

Currency trade experts, additionally referred to as foreign exchange (forex) agents, play a vital role in advising individuals and organizations on global money transfers. Their know-how extends past executing transfers; they provide comprehensive financial steerage, making sure you are making informed decisions that align with your particular wishes and hazard tolerance.

Benefits of Engaging Currency Exchange Specialists:

- Market Expertise: Currency exchange experts possess deep know-how of global foreign money markets, alternate price fluctuations, and monetary elements that have an impact on transfer charges.

- Tailored Strategies: They can examine your switch necessities, chance urge for food, and monetary goals to expand custom-designed strategies that maximize your financial savings and decrease risks.

- Risk Management: Their understanding extends to hazard management strategies, protecting you from unfavorable change price movements and potential market disruptions.

- Negotiation Power: Currency alternate experts frequently have installed relationships with banks and monetary establishments, letting them negotiate favorable exchange costs and fees on your behalf.

- Regulatory Compliance: They are properly versed in global financial regulations and compliance necessities, ensuring your transfers adhere to prison and ethical requirements.

When to Consult a Currency Exchange Specialist?

Consider searching for expert steering in case you are:

- Transferring Substantial Amounts: For massive or high-price transfers, the ability to financial savings and threat mitigation can significantly advantage your average economic goals.

- Navigating Complex Transactions: If your transfers involve complex forex pairs, a couple of currencies, or precise necessities, an expert can offer tailor-made answers and navigate the complexities.

- Managing Currency Risk: If you are involved in the impact of alternate charge fluctuations to your transfers, a consultant can expand techniques to mitigate risks and defend your financial pastimes.

- Seeking Personalized Advice: If you require customized recommendations and guidance unique to your circumstances, a currency exchange professional can provide expert suggestions tailored to your wishes.

Making Best Decisions in a Globalized World

Choosing the best currency exchange company in the world is 1 of the challenge for you for international cash transfers, know-how is a strength. By expertise in the intricacies of the system, evaluating the pinnacle 10 groups, embracing generation, and in search of professional guidance while essential, you may empower yourself to make knowledgeable selections that optimize your transfers and maximize your financial savings. Navigate the labyrinth of global cash transfers with confidence, and embody the interconnected international that awaits you.

Unleashing the Power of Global Connections

International money transfers have revolutionized the manner we connect and transact in modern-day globalized international. Whether you are helping loved ones overseas, managing overseas enterprise ventures, or pursuing personal aspirations, the potential to seamlessly switch budgets across borders has become a vital tool.

By knowing the complexities of worldwide money transfers, evaluating the top-tier carriers, and leveraging the era for informed selection-making, you may navigate the labyrinth of economic transactions with self-belief and free up a world of opportunities.

Breaking It Down by Trust & Credibility

When it comes to the Trust and credibility component of The Monito Score, Wise, TransferGo, and Instarem are the strongest services for the following reasons:

- Wise: Moves more than US$70 billion across borders for more than 10 million customers every year;

- TransferGo: Around 2.5 million customers and around £1 billion being handled in transfer principal;

- Instarem: Since its establishment in 2014, Instarem has grown to serve two million customers, employ over 200 people, and transfer over US$4 billion worldwide annually.

Worthy Mentions and Special Considerations

While some providers earn a higher Trust & Credibility score than others, it’s well worth keeping in mind that every service you encounter on Monito is completely trustworthy and meets, at minimum, a set of stringent trust and security criteria. These include top-notch security protocols such as segregated user accounts, 128-bit encryption, and HTTPS, as well as due authorization by relevant financial regulators.

Other money transfer services that rank well in the Trust & Credibility category, which didn’t make the top three include Remitly (8.9/10), CurrencyFair (8.5/10), and Remessa Online (9.0/10).

Worthy mentions also go to Western Union (7.5/10), MoneyGram (7.6/10), and Ria (8.0/10) — which despite seeing their Trust & Credibility scored lowered as a result of non-transparent pricing — remain the largest, second-largest, and third-largest money transfer companies on the globe and are highly credible services as a result.

Who is the largest money transfer provider?

In terms of company size and value, PayPal is the largest money transfer company.

Followed by Western Union and Moneygram.

However, I wouldn’t recommend these companies to you.

You’ll get some of the worst rates on the market, paired with a not-so-good service.

Out of the companies I would recommend, Wise is the largest.

Their revenue came out at nearly £600m for 2022.

Breaking It Down by Service Quality

When it comes to the Service Quality score, Wise and TransferGo once again perform well and are joined by Western Union to form the top three services for this scoring category. For each service, the placement came down to the following factors respectively:

- Wise: Registering an account and setting up a money transfer is speedy and seamless;

- TransferGo: Setting up a money transfer is straightforward, and customer support is conveniently reachable;

- Western Union: An almost unmatched scope of pay-in and pay-out methods are available.

Worthy Mentions and Special Considerations

Other services to show their strength in this category include Paysend (8.0/10), Remessa Online (7.7/10), CurrencyFair (7.5/10), and PayPal (7.8/10), the latter of which we don’t recommend for international money transfers due to the fees despite its convenient mobile transfer platform.

Breaking It Down by Fees & Exchange Rates

In the Fees & Exchange Rates category, Remitly, Wise, and Global66 show themselves to be the best-priced money transfer services based on data from hundreds of thousands of searches on Monito’s comparison engine:

- Remitly: Cheapest and competitive on 15% of available Monito searches for bank transfers and 64% for cash pick-ups for all 12 months of 2022;

- Wise: Cheapest and competitive on 19% of available Monito searches for bank transfers for all 12 months of 2022;

- Global66: Cheapest and competitive on 10% of available Monito searches for bank transfers for all 12 months of 2022.

Worthy Mentions and Special Considerations

The cheapest money transfer service can be very specific from region to region. Therefore extremely well-priced services specialising in individual corridors may not feature in our global results above.

For example, for transfers from Singapore, Hong Kong, and Australia, SingX is very frequently the best-priced and most competitive service of all, even more so than Wise or Remitly. Similarly, for transfers from Switzerland, specialist services b-Sharpe and Wise often offer the best pricing, while for transfers from the UK to Poland, TransferGo frequently comes out on top (although XE Money Transfer is very competitive on this corridor too.)

Also worthy of mention is WorldRemit, which is cheapest for 15% of available Monito searches for cash pick-ups but did not make it into the top three.

To get around this problem and make sure you’re finding the best deal for your specific transfer corridor, we recommend running a search on Monito’s real-time comparison engine.

Breaking It Down by Customer Satisfaction

By Customer Satisfaction, the best money transfer services on Monito are Revolut Money Transfer, Wise, and XE Money Transfer, which consistently impressed their customers with the following metrics:

- Revolut Money Transfer: From millions of reviews on Google Play and the App Store, Revolut earned a 4.5 and 4.9 score, respectively;

- Wise: Around 85% of 116 thousand customers who gave their feedback on Trustpilot rated Wise five out of five stars;

- XE Money Transfer: Around 95% of 45 thousand customers who gave their feedback on Trustpilot rated XE five out of five stars.

Worthy Mentions and Special Considerations

Many services on Monito rank very highly with their customers, and some only just missed making it into the top three. These include TransferGo (9.6/10), Azimo (9.6/10), and Remitly (9.5/10).

Best Money Transfer Organizations for Various Use Cases

Each money transfer specialist has its strengths and weaknesses, with some being better suited for transfers between certain countries while others shine at particular pay-in methods. Take a look at the breakdown below to discover the top providers for major use cases according to The Monito Score and data from hundreds of thousands of searches on Monito’s real-time comparison engine.

Best Money Transfer Company By Service Type

Whether you want to send a traditional cash pick-up or an instant electronic transfer, rates will vary:

- Best overall for bank transfers: Wise

- Best for cash pick-ups: Remitly

- Best for card transfers: Revolut Money Transfer

- Best for mobile money: WorldRemit

- Best for coverage: Western Union

- Best for desktop transfers: Wise

- Best for mobile transfers: Wise

- Best for offline transfers: Western Union

- Best for customer support: Wise

- Best for transparent pricing: TransferGo/Wise

Best Money Transfer Services By Region

Rates vary widely depending on your country of origin and your recipient’s country. International money transfer companies often specialize in a geographic area or country. Have a look at our data-backed recommendations for various country corridors.

From the Americas

- Best for sending money from the US to India: Remitly

- Best for sending money from the US to Canada: Currencyfair

- Best for sending money from the US to Mexico: Remitly

- Best for sending money from Canada to the US: Wise

- Best for sending money from N. America to Europe: Currencyfair

- Best for sending money from S. America to N. America: Global66

- Best for sending money from N. America to S. America: Remitly

From Europe

- Best for sending money from the UK to Poland: Remitly

- Best for sending money within Europe: Currencyfair

- Best for sending money from Switzerland: Wise

- Best for sending money from Europe to N. America: Currencyfair

From Asia

- Best for sending money from Asia to Europe: Remitly

- Best for sending money from Asia to N. America: Wise

- Best for sending money within Asia: Wise

- Best for sending money from Singapore: SingX

- Best for sending money from Brazil: Remessa Online

Understand the Fees to Transfer Money Internationally

In the worst case (with banks), your recipient may be charged a receiving fee! Not to worry, we only recommend transparent services that waive this kind of fee. As we go through the list, keep in mind that you will usually be charged these two fees for international money transfers:

- Commission fee: This is an industry-standard sending fee that is charged for the service. It may come at a fixed price or as a percentage of the transaction total.

- Exchange rate margin: Some companies apply an exchange rate that is weaker than the live mid-market rate. They will pocket this markup difference.

Find The Best Money Transfer Organization For Your Needs

Regardless of whether security, price, service quality or other customers’ opinions is the most important factor for you when looking for a money transfer service, there is plenty to compare to find the best deal to suit your individual needs.

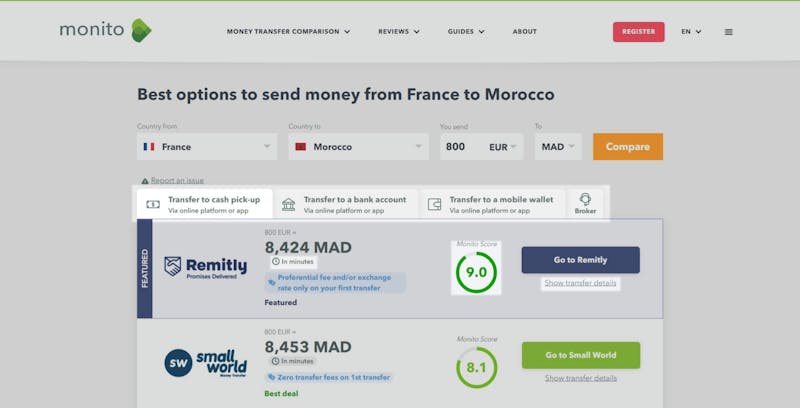

On Monito’s award-winning comparison engine, you’ll not only be able to compare money transfer services by the cost, but you’ll also be able to rank and select money transfer services by their Monito Score, aspects of their service (e.g. pay-in and pay-out methods), transfer time, and explore the transfer details, as highlighted below:

image reference Monito

To get started, simply run a search on Monito’s comparison engine and find the best service to suit your needs:

4 Important Factors To Look For in International Money Transfer Companies

We’ve spent years independently comparing and reviewing transfer services across the globe. That’s why we’ve launched the Monito Score, the culmination of hours of research by our money transfer experts, multiple tests of each, and leveraging millions of pricing data points from Monito’s comparison engine.

The Monito Score: How Monito Reviews Money Transfer Services

The Monito Score ranks money transfer companies objectively on twelve criteria in the following four categories to help you make informed decisions:

- Trust & Credibility: A confidence ranking based on several factors such as authorization by financial regulators, use of security protocols, company size, and fee and exchange rate transparency;

- Service Quality: A service score based on a qualitative test of a service’s web and mobile apps to determine the ease of opening a new account, making a transfer, contacting customer support, and ordering/managing an associated debit/credit card;

- Fees & Exchange Rates: A price ranking determined by how often a service is cheapest across hundreds of thousands of searches on Monito’s comparison engine and how often the total cost of sending 1,000 US dollars overseas is below 1.5%;

- Customer Satisfaction: A customer-centric ranking based on how many five-star reviews customers have given to a service on Trustpilot weighted against the absolute number of four- and five-star reviews the service has received.

Taken together, these four categories combine to form The Monito Score, a score out of 10 awarded to each money transfer service that provides a detailed and nuanced overview of the quality of their service.

How We Rank the Best International Money Transfer Companies and Organizations

All services reviewed by Monito undergo a rigorous evaluation to assess the quality of their service.

When reviewing a money transfer service, our experts start by opening a user account to test out its functionalities, including the ease of registration and speed of transferring money. This provides a well-rounded overview of the platform’s strengths and limitations. Next, we weigh this score against several other key criteria, including customer reviews, percentage of fees constituted by exchange rate margins, pay-in options, access to customer service, business and legal metrics such as volume transferred appropriate authorization and company size.

Finally, we run an analysis of hundreds of thousands of searches on Monito’s comparison engine to determine how often the service in question is the cheapest and how often it was competitive against its rivals, giving a reliable overview of the service’s pricing concerning the market. As a final step, the review process is then repeated by a second reviewer to peer review and cross-reference.

Informed Decisions: Your Key to Financial Empowerment

The electricity of knowledgeable selections lies at the coronary heart of optimizing your global cash transfers. By cautiously considering factors such as destination U. S., transfer amount, desired speed, and desired payment techniques, you can pick out the provider that high-quality aligns.

Reference: https://www.monito.com/en/wiki/best-money-transfer-services

https://www.topmoneycompare.com/guides/top-10-international-money-transfer-companies